More with Flex

Just as the name says, invoice finance Flex allows you to stay flexible. But that’s not the only advantage.

Easy to plan

Tailor your liquidity to your current requirements.

Fast

You will receive payment within 24 hours.

Risk-free

Once a credit check comes back positive, we’ll assume the default risk.

Transparent

You know which costs you will incur and when – at all times.

The factoring test

All entrepreneurs have different approaches when it comes to liquidity. Take our test to see whether invoice finance is right for you.

VIDEO: Discover how grenke invoice finance can unlock immediate cash flow and empower your business to thrive.

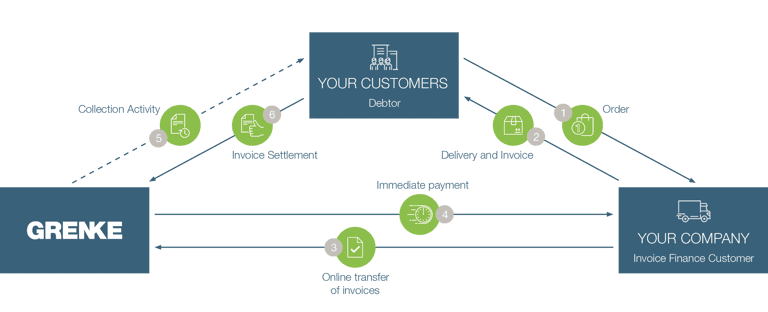

INFOGRAPHIC: A step-by-step guide

Compare our products

What can our other invoice finance products do for you? Our comparison makes it clear.

Invoice Finance Classic

Invoice Finance Flex

Invoice Finance Choice

Assumption of complete accounts receivable management

Pre-financing for specific invoices

Pre-financing of selected accounts receivable

Credit checks for entire customer bases

Credit checks for selected accounts receivable

Our team’s expertise

At Grenke invoice finance, our dedicated team combines years of finance experience with industry expertise to support your business’s growth. Our account managers and credit specialists offer personalised, tailored solutions and exceptional service to ensure you have the financial flexibility to thrive. Meet the team that drives our success.

FAQs | Flex

What is Flex, and how does it differ from Classic?

Flex invoice finance from grenke is a versatile solution that offers greater flexibility compared to Classic Invoice finance. With Flex, you can choose specific invoices to factor as needed, rather than committing all invoices or entering into a long-term agreement. This allows you to manage your cash flow more dynamically, giving you control over which invoices to advance and when, based on your immediate financial needs.

What are the benefits of using grenke Flex invoice finance?

Grenke Flex invoice finance provides several key benefits, including:

- Customisable cash flow management: Factor individual invoices or groups of invoices as needed.

- Immediate access to funds: Receive cash quickly, usually within 24 to 48 hours, to address urgent financial needs.

- Improved financial flexibility: Adjust your factoring usage based on your business’s fluctuating cash flow requirements.

How does the fee structure for Flex invoice finance work?

The fee structure for Flex invoice finance is similar to Classic invoice finance but may vary based on the specific invoices you choose to factor and the volume of factoring activities. Fees are generally based on a percentage of the invoice value and are clearly outlined before you commit. We aim for transparency in all our charges, ensuring you understand the costs involved and can plan accordingly.